Exited Startups

Due to the continuous activity of the Iran Technology Development Fund in the field of venture capital, since the beginning of its activity, various businesses have exited the fund’s portfolio in the form of the following exit scenarios:

- Selling stocks to entrepreneurs

- Selling stocks to investors

- Project failure

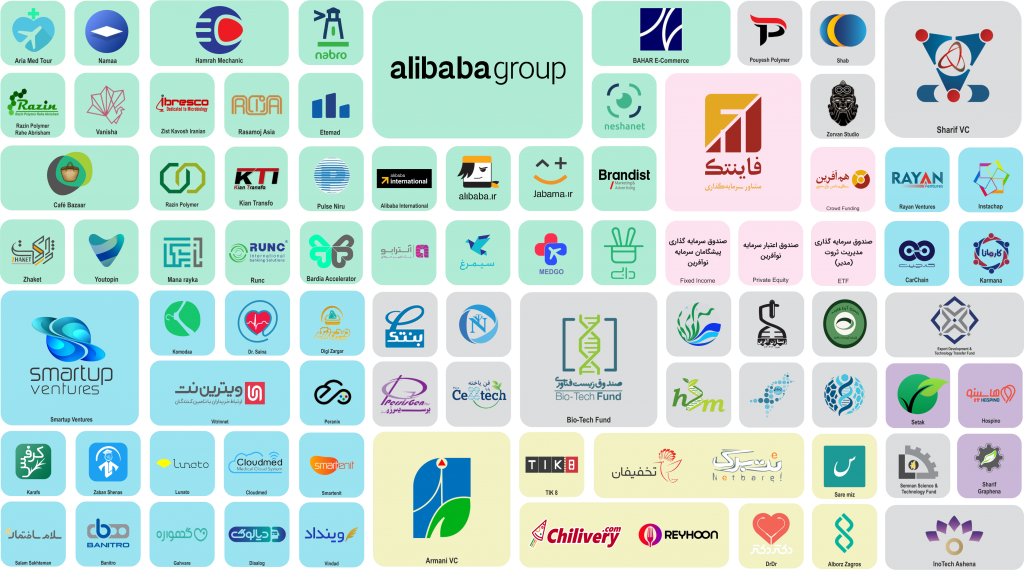

Investment Companies

By considering the scope and type of the startup activity and performing accurate evaluation in terms of its respective team, financial state, goals and vision, Investment companies provide startups with financing against partnership and receiving shares based on the value of the business. After partnership, venture capital firms also provide startups with consulting, mentoring and comprehensive cooperation services aim to achieve growth, development, revenue and profitability.

VC Investment Funds

In 2015, the regulation for establishment of the VC Funds was approved by the Stock Exchange and Securities Organization with the aim of collecting financial resources and investing in securities of the legal entities in order to provide startups and innovative projects with financing for their development and commercialization. In general, these funds, instead of investing in stocks and securities, provide financing for companies with rapid growth.

Research and Technology Fund

Research and Technology Funds were established during the Third Economic, Social and Cultural Development Program in order to promote the cooperation, investment and comprehensive support of the private sector from research and technology activities. These funds are aimed to provide facilities for technological projects, issue guarantees required by private research and technology institutes, provide capital for innovative projects, as well as provide financial and consulting services to knowledge based startups.

Investment Consulting Firms

In addition to providing financing services, investment consulting firms try to select securities for their investment portfolio, taking into account the amount of risk for individuals and legal entities and their targeted return. FinTech Investment Consulting, with which Iran Technology Development Fund cooperate, provides financial services in two ways. The first method is to finance startups by attracting capital, and the second method is to finance mature companies by issuing securities in the capital market.

Accelerators

Within the seed money stage of startups funding, accelerators try to provide startups with services such as mentoring, training and networking besides helping to attract A round funding. By cooperating in this area, Iran Technology Development Fund is trying to play an effective role in the growth and development of startups.